First Savings Bank launches Mastercard® SecureCodeTM, a free service designed to augment your existing First Savings Bank Mastercard® account. The security code works like a personal identification number (PIN) at an ATM. Enter your secret security code when prompted by First Savings Bank at participating online retailers when driven by First Savings Bank. Once your identity is verified, your purchase is complete.

The 1st Savings credit card is a Mastercard issued by First Savings Bank. Cardholders with poor credit histories can apply for the card, an unsecured credit card with a high-interest rate that differs by creditworthiness.

When you shop online at participating retailers, you’ll receive a personal security code that protects you against unauthorized card use. The FSCC has a variable APR and an annual fee. It all depends on your credit rating.

Application Procedure At Firstsavingscc.com

The steps to apply for a First Savings credit card are listed below:

- First, go to the official First Savings Credit Card website in your favorite browser.

- Now click on the “Accept Online” button, and the application page will appear.

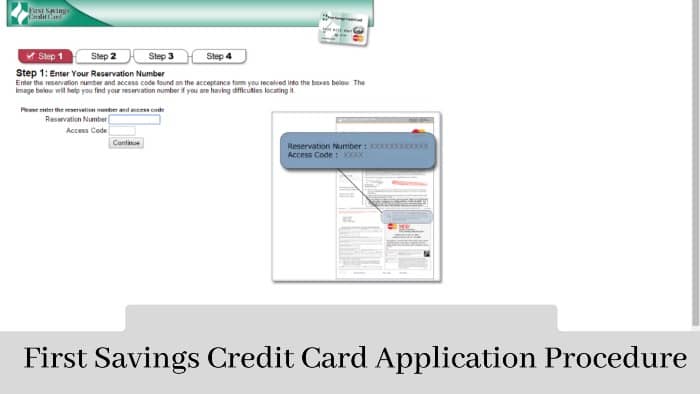

- You will need to enter the “reservation number” and “access code” on the next page that you received in the mail acceptance form.

- After entering the necessary codes, click the “Next” button.

- You need to follow four steps to apply for a credit card.

- In the second step, you need to enter information about your mailing address to verify it.

- Then, in step 3, you will need to provide more information to verify the acceptance form.

- You must complete the application in the 4th and last step by accepting the offer.

- During the entire application process, you must provide all information such as Your data, income or employment status, etc.

Requirements For The Firstsavingscc Application Process:

A few conditions are to meet before applying for First Savings Credit Card:-

- Applicant age must be 18 years or older.

- The applicant must have an easily recognizable bank statement

- SSN is mandatory

- The applicant must be a legal resident of the United States.

Guide To First Savings Credit Card Login

Assuming you have already received your First Savings credit card. How do you log into the online account associated with your new credit card?

The process is simple. And luckily for you, in this section, we show you a step-by-step guide for First Savings Credit Card Login. So let us discuss the guide for First Savings Credit Card Log in the below steps.

The steps for First Savings Credit Card Login are listed below:

- Visit your favorite browser’s official First Savings Credit Card website (www.firstsavingscc.com).

- Then you need to click the “Account Registration” button from there.

- You will need to enter the ‘username’ and ‘password’ on the next page for your First Savings credit card account.

- Click ‘Login’ and enter your information.

- And you can access your First Savings credit card account.

- Once connected to your First Savings credit card account via the mobile app, you can also use it directly from the app.

Requirements of First Savings Credit Card Login

FirstsavingsCC login requirements are listed below:

- PCs, laptops, smartphones, iPads, and tablets.

- Good internet connection.

- First Savings Credit Card website (www.firstsavingscc.com).

- Username and password.

- Code of security, social security number, account number, and credit card expiration date (day, year, month).

- Google Chrome, Mozilla Firefox, Microsoft Internet Explorer.

- The First Savings Credit Card mobile app is available on the Google Play Store.

Benefits of First Savings Credit Card Login

- You can shop easily.

- Accessing an online account is secure.

- If you accidentally lost your card or misplaced it, you can get it back with Fraud Coverage.

Reset Username Or Password At www.firstsavingscc.com

After registering with your First Savings credit card, the next step is to find your account details at www.firstsavingscc.com. For this, we need to access the First Savings Credit Card Login. Many First Savings credit card account holders often forget their username or password when logging in.

We have listed the following steps to reset your FirstsavingsCC login username or password to resolve this issue. The steps to reset your First Savings credit card username or password are as follows:

Step 1: First, visit the official First Savings Credit Card homepage or click this link [https://firstsavingscc.com/CardMemberServices/default.aspx].

Step 2: After that, click on Forgot Username/Password?

Step 3: Enter some details required for account verification: account number, expiry date, last three digits of your card security code, and last four digits.

Ways To Activate Your FirstsavingsCC

But now the question arises whether it is possible to activate the First Savings Credit Card (FirstsavingsCC)? See here in detail.

After receiving this card, you should activate it online. You can also start it via the web portal or the company in the activation area provided.

- Visit the FirstsavingsCC activation screen.

- On the pop-up page, you will see the “Register new user” section, where you want to fill in some details: account range, cancellation date, cardholder security code, last four digits of CPF number, and click “Accept.”

- It takes 1-2 days to set up FirstsavingsCC.

Benefits Of First Savings Card

Many First Savings Credit Card Account holders apply for their respective credit cards after reading First Savings Credit Card Reviews and what benefits they get from First Bank Savings Credit Card. The benefits of the First Savings Credit Card are listed below:

Insecure card: You know this is an unsure credit card. You do not need to pay a deposit before receiving this card.

No Hidden Fees Or Penalty: This card does not have hidden charges or penalties. Your offer will cover everything.

Fraud Protection: Suppose you lose your card; nothing to fear. You have full fraud coverage for lost or stolen cards.

No monthly or one-time fees: There are no monthly or one-time fees with this credit card. You have to pay an annual fee, so you don’t have to worry about the monthly payment.

Payment Of First Savings Bank Credit Card Bill

There are several ways to pay your credit card bill, for the record. In this section, we’ll talk about them.

Online Account Usage

First, you can quickly pay your bill directly from the First Savings Bank Credit Card online services portal. You need to log into your First Savings Bank Credit Card account to do this. And from there, you can do the work.

Moneygram Or Western Union Transfer

If you’re not good online or on the web, you can use money transfer systems like MoneyGram or Western Union to pay your First Savings credit card bill.

- For MoneyGram, you must use code 3890.

- For Western Union, you must use this code: City/State: FSCC/SD.

Offers Available At First Savings Credit Card

The First Savings Credit Card does not provide much information about its programs or offers. Previously, they offered six offers. However, there are now only five offers.

However, they had five different offers with different APRs and annual fees. As usual, your eligibility for these offers depends on your credit score and other factors, such as your income. Writing this article has five offers which you can see in the table below.

Offer No #1

APP For Purchase: 14.90% (Will vary depending on the Prime Rate)

APR For Cash Advances: 23.90% (Will vary depending on the Prime Rate)

Annual Fee: None

Offer No #2

- APP For Purchase: 29.9%

- APR For Cash Advances: 29.9%

- Annual Fee: $75

Offer No #3

- APP For Purchase: 29.9%

- APR For Cash Advances: 29.9%

- Annual Fee: $49

Offer No #4

- APP For Purchase: 29.9%

- APR For Cash Advances: 29.9%

- Annual Fee: $75

Offer No #5

- APP For Purchase: 29.9%

- APR For Cash Advances: 29.9%

- Annual Fee: $75

Customer Service

First Savings Credit Card establishes customer service centers to assist their customer regarding queries and complaints. In this First Bank Savings Credit Card Contact center, we will resolve your questions and complaints regarding your registration, login, payment, website issue, etc. Customers can call the First Savings credit card phone number between 7:00 am and 9:00 pm Central Standard Time. The Customer Service team is available from 7 am to 9 pm for the Savings Credit Card.

If you have not found answers to all of your questions or concerns on this website (www.FirstSavingsCC.com), don’t hesitate to contact the First Savings credit card phone number. Our customer care executives will be happy to assist you as soon as possible. First Savings credit card phone numbers are here: 1-888-469-0291.

| Official Site | First Savings Credit Card |

|---|---|

| Country | United States Of America |

| Registration Required | Yes |

| Portal Type | Login |

| Managed By | Mastercard International, Inc. |

Mobile App For 1st Savings Credit Card

Many users have smartphones, iPads, and tablets with Apple or Android versions. Smartphones allow users to carry out many financial transactions, purchases, sales, and returns of products through e-commerce websites, online applications, payments, receiving money, and checking in use online applications and websites. Smartphones have facilitated our daily transactions with good data connections. We will soon briefly explain the mobile application used for the first savings credit card on this page.

The First Savings Bank Credit Credit card app is free for all smartphone users. It is available on the Google Play Store, where you can download and install it on your phone. The Features of the First Savings Credit Card are as follows:

- Access your 1st Savings Credit Card from First Savings Bank (Beresford, SD) with the First Savings Bank mobile app.

- View transactions, pay your bill or check your balance.

- Quick and easy account access (on supported devices)

- Touch ID® and Face ID® for secure login

- Stay informed when you’re on the go

- Check your account activity by subscribing to account notifications and setting your notification preferences.

- Manage notifications when a payment is due or when it has cleared.

About First Savings Bank

First Savings Bank, a family-owned community bank, was founded in 1913 in Beresford, South Dakota, his home. They pride themselves on treating each of our customers with the attention and care they deserve.

First Savings Bank has a long history of offering interested parties a wide range of South Dakota financial products. After all, it began in 1913 to assure interested parties that you understand your business and understand it well. For this reason, interested parties should check First Savings Credit Card Reviews to see if these products are suitable for them or not.

Frequently Asked Questions

Following are the Frequently asked questions regarding the First Savings Credit Card:

How Long Does It Take For The First Savings Card To Be Approved?

The First Savings credit card page does not indicate how long you can wait for a decision on your application. In some cases, credit card lenders offer an instant decision when you apply online, but it’s also not uncommon for lenders to take a few weeks to decide on a candidate.

Can I Get A Cash Advance With A First Savings Credit Card?

You can get a cash advance with First Savings Mastercard, depending on your credit score. However, most cardholders pay the 2% cash advance plus 29.9% APR on balance.

For cardholders who receive an APR of 16.40% with no annual fee, the credit card agreement provides that the price for a cash advance is $10 or 4% of the passage, whichever is greater, plus a 25.40% APR on each balance.

Conclusion

You can use the First Savings Credit Card to build your credit from First Savings Credit Card Reviews. Whether you are borrowing money for a house or a personal loan, you will have to prove your credibility most of the time. It’s part of life, and taking out a loan is a great habit to acquire as soon as possible. First Savings Credit Card Reviews are essential to know before applying for the same.

If your credit card history is terrible, you can apply for the First Savings Bank credit card. This card will be for your high-risk candidates. Customers can use this card to build their credit card history as it provides a platform for their new applicants who are not eligible to apply for Discover and Chase due to their low credit card history.